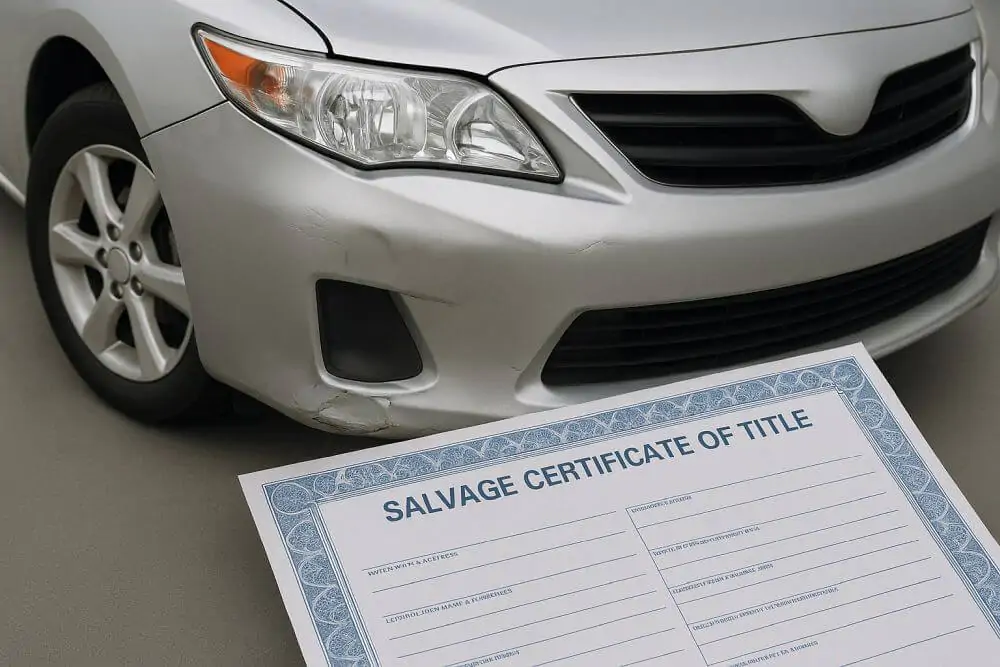

Salvage title vehicles represent a high-risk, niche segment of the used car market. Once declared a total loss by insurers due to major damage, they exist on a spectrum from repairable to fundamentally compromised. While offering deep discounts for informed, skilled buyers who accept the risks, they pose significant financial, legal, and safety challenges that make them unsuitable for most consumers.

Salvage title vehicles represent a high-risk, niche segment of the used car market. Once declared a total loss by insurers due to major damage, they exist on a spectrum from repairable to fundamentally compromised. While offering deep discounts for informed, skilled buyers who accept the risks, they pose significant financial, legal, and safety challenges that make them unsuitable for most consumers.

Deciphering the Salvage Designation

Understanding what a salvage title truly represents is the critical first step. It is not merely a note on a car's history; it is a legal declaration that fundamentally alters the vehicle's status, value, and future.

The Legal and Financial Definition

The core of the salvage title meaning is economic, not strictly mechanical. An insurance company declares a vehicle a "total loss" and issues a salvage title when the estimated cost to repair it exceeds a certain percentage of its pre-accident Actual Cash Value (ACV). This threshold varies but is commonly between 70% and 90%. It's crucial to understand that this decision is based on repair costs (using new OEM parts and standard labor rates) versus the car's market value. A relatively new car with moderate damage can be totaled, while an older car with severe damage might not, if its value is low enough. The salvage brand is a permanent mark on the vehicle's title, indicating it was once deemed unfit for standard road use due to a major incident.

From Salvage to Rebuilt: The Path to Legality

A salvage-title car cannot be legally driven on public roads. To become street-legal again, it must undergo a rebuild process overview and pass a state-mandated inspection to earn a "Rebuilt" or "Reconstructed" title. This process varies by state but generally involves: 1) Documenting all parts used in the repair, often requiring receipts for major components. 2) A rigorous safety inspection by a state official or licensed inspector to ensure the vehicle is structurally sound, all safety systems (lights, brakes, airbags) function, and it is safe for the road. Only after passing this inspection can the vehicle be registered and insured for normal use. The quality of this rebuild is the single greatest variable determining the car's future reliability and safety.

Navigating the Practical Realities and Restrictions

Owning a vehicle with a branded title introduces a host of limitations that do not apply to clean-title cars. These restrictions impact nearly every aspect of ownership, from daily use to long-term planning.

The Maze of Insurance and Financing

Insurance restrictions are the most immediate and significant hurdle. Most major national insurers will not offer comprehensive or collision coverage on a salvage or rebuilt-title vehicle. You will typically be limited to liability-only coverage, meaning any future damage to your car will not be covered. If the car is stolen, you will not receive a payout. Some specialty insurers may offer full coverage, but at very high premiums and with a drastically reduced insured value (often 50-60% of a clean-title car's value). Similarly, legal limitations extend to financing. Banks and credit unions almost universally refuse to finance salvage-title vehicles due to their uncertain collateral value. Purchases must be made with cash, limiting the buyer pool and your own financial flexibility.

The Perpetual Challenge of Resale

The resale challenges associated with a branded title are severe and permanent. The market for these vehicles is narrow, consisting almost entirely of other risk-tolerant individuals or mechanics. Selling the car will be difficult and time-consuming, and you should expect to recover only a fraction of what you paid, regardless of how well it runs. The title brand creates a profound and lasting stigma that dramatically depreciates the vehicle's value. You are, in essence, purchasing a vehicle with its future economic value already largely expended.

Conducting a Disciplined Risk Assessment

Considering a salvage-title car is not shopping; it is conducting a forensic analysis. The potential upfront savings must be weighed against a comprehensive and clear-eyed evaluation of risk, repair quality, and your personal circumstances.

The Imperative of Investigating Cause and Quality

A thorough risk assessment begins with uncovering the cause of the salvage designation. A car totaled due to extensive hail damage (cosmetic only) presents a completely different risk profile than one totaled from a frontal collision with airbag deployment or flood submersion. Obtain the vehicle's history report and, if possible, the insurance company's appraisal or photos of the pre-repair damage. Next, you must verify the quality of the rebuild. This requires a pre-purchase inspection by a highly qualified mechanic, ideally one with auto body expertise, who can assess frame alignment, the quality of weld repairs, the installation of safety components (especially airbags, using new OEM parts), and the integrity of the electrical system. A poorly rebuilt car is not just unreliable; it can be a safety hazard.

Defining the Ideal (and Non-Ideal) Buyer

A salvage-title car is suitable only for a very specific individual. The ideal buyer is a skilled mechanic or has a trusted professional who can thoroughly vet the repair and perform future work. They must pay cash, plan to drive the vehicle for many years until its end of life (avoiding the resale problem), and have a high tolerance for potential unforeseen issues. They must also secure appropriate insurance beforehand. This is categorically not a choice for a primary daily driver for most people, a first-time buyer, someone seeking a reliable long-term asset, or anyone who requires financing or full-coverage insurance. The "reward" of a low price is directly proportional to the "risk" of accepting all future liability and uncertainty.

Q&A

Q: What exactly does a 'salvage title' mean?

A: The salvage title meaning is legal and financial. It means an insurance company declared the vehicle a total loss because repair costs exceeded a high percentage of its pre-accident value. It is a permanent brand on the vehicle's title, indicating it was unfit for road use due to a major incident (crash, flood, fire).

Q: Can I get full coverage insurance on a rebuilt title car?

A: Insurance restrictions make this very difficult. Most mainstream insurers will only offer liability coverage. Some specialty companies may offer full coverage, but premiums are high and the insured value will be based on the car's reduced worth as a rebuilt vehicle, not its pre-accident value.

Q: How can I check if a rebuild was done properly?

A: You must go beyond a standard inspection. Hire a mechanic with frame and structural repair experience. They should check for proper frame alignment, quality of welding on cut-and-replaced sections, evidence of water damage, functionality of all airbags and safety systems, and signs of shoddy repair like excessive filler or mismatched parts. Documentation of the rebuild process is also key.

Q: Is it impossible to resell a car with a rebuilt title?

A: Not impossible, but resale challenges are immense. Your buyer pool shrinks dramatically. You must sell to another informed risk-taker, and the price will be a fraction of a clean-title equivalent. It will take longer to sell and often requires private sale, as most dealers will not accept it as a trade-in.

Q: Who should actually consider buying a salvage/rebuilt title car?

A: Only those who pass a strict risk assessment: experienced mechanics, hobbyists seeking a project, or cash buyers who need ultra-cheap transportation and plan to drive the car into the ground. They must have expert inspection resources, accept liability-only insurance, and have no need for future resale value. For nearly all others, it is an inadvisable risk.