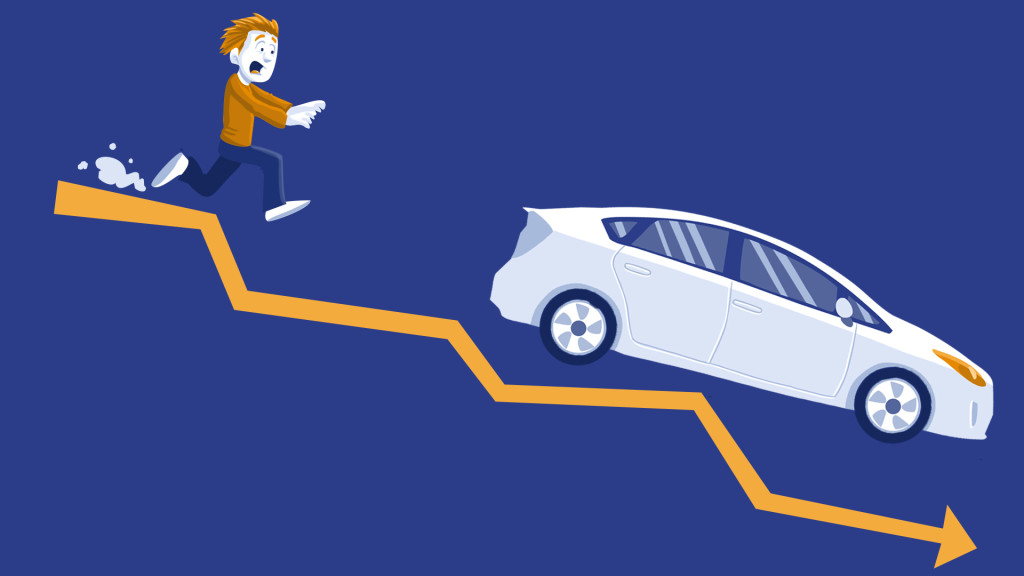

For the vast majority of consumers, an automobile is a depreciating asset. Its loss in value is not random but follows a remarkably predictable, non-linear trajectory shaped by market forces, psychological factors, and engineering realities. Understanding this depreciation curve is not merely academic; it is a foundational financial skill that empowers individuals to make strategic decisions, transforming a car from a liability into a tool for optimized transportation expenditure.

For the vast majority of consumers, an automobile is a depreciating asset. Its loss in value is not random but follows a remarkably predictable, non-linear trajectory shaped by market forces, psychological factors, and engineering realities. Understanding this depreciation curve is not merely academic; it is a foundational financial skill that empowers individuals to make strategic decisions, transforming a car from a liability into a tool for optimized transportation expenditure.

The Mechanics and Phases of Depreciation

Depreciation is the single largest cost of new car ownership, often eclipsing fuel, insurance, and maintenance combined in the initial years. This erosion of value occurs in distinct, identifiable stages, each driven by different economic and behavioral principles.

Deconstructing the Phases of Value Loss

The journey of a vehicle's value can be broken down into several key depreciation phases explained. The first and most severe is the Initial Shock Depreciation, which occurs the moment a new car is driven off the dealership lot. The vehicle instantly transitions from "new" to "used," a psychological and market shift that typically erases 20% to 30% of its Manufacturer's Suggested Retail Price (MSRP) within the first year. This sharp decline is influenced by the immediate availability of identical, untouched models on dealer lots and the market's discount for the unknown usage history of the now-used vehicle. Following this shock, the vehicle enters a period of Steep Linear Decline, typically spanning years two through four. During this phase, the car continues to lose a significant percentage of its remaining value annually, often between 15% and 25% per year, as it moves further from its new-car status, accumulates mileage, and newer models with updated technology enter the market.

Analyzing the Trajectory of the Price Drop

Mapping the value drop timeline provides a concrete view of this financial trajectory. Industry data consistently shows that a typical mass-market vehicle will lose approximately 50% of its original MSRP by the end of its third year of ownership. Luxury and niche vehicles often experience an even steeper initial decline due to higher maintenance cost perceptions and rapid model updates. The curve begins to flatten significantly around the five-to-seven-year mark. By this time, the vehicle has absorbed the bulk of its model-cycle depreciation, its technology is no longer cutting-edge, and its value becomes more closely tied to its functional utility, proven reliability, and remaining service life rather than its novelty. This transition point is critical for understanding long-term ownership economics.

Strategic Ownership for Financial Optimization

Once the pattern of depreciation is understood, it can be leveraged to define periods of ownership that maximize value retention and minimize total cost. The goal shifts from avoiding depreciation to managing its impact on your personal finances.

Identifying the Most Cost-Effective Ownership Windows

Determining the best ownership periods depends on whether one prioritizes minimizing total loss or maximizing reliability per dollar spent. For the buyer seeking to avoid the steepest losses, purchasing a vehicle that is two to three years old is often considered the "sweet spot." At this age, the car has already absorbed the punishing initial depreciation, yet it is still relatively modern, likely under some form of factory warranty, and has many years of useful life remaining. For a different strategy focused on cost efficiency analysis, acquiring a vehicle as it enters its price stability years—typically between years five and ten—can be optimal. During this plateau phase, annual depreciation slows dramatically, often to just 5-10% per year. The purchase price is low, and if the vehicle has a strong reputation for durability, the total cost of ownership (purchase price plus maintenance, repairs, and operating costs) over a five-year holding period can be exceptionally competitive.

The Financial Logic of the Depreciation Plateau

The concept of price stability years represents a fundamental shift in a vehicle's financial profile. When a car's depreciation rate slows, its ownership cost becomes dominated by operational expenses like fuel, insurance, and maintenance, rather than pure value loss. This period, sometimes called the "value trough," is where the vehicle delivers the most transportation utility for the lowest capital investment. A well-maintained car in this phase can offer several years of reliable service with minimal loss in resale value, making it an extremely efficient asset. The key to capitalizing on this period is selecting models known for their long-term reliability and low cost of repair, ensuring that maintenance costs do not offset the savings from slowed depreciation.

Advanced Analysis and Timing Considerations

A sophisticated understanding of depreciation involves recognizing the variables that alter the curve and applying this knowledge to buying and selling decisions. This transforms depreciation from a passive loss into an active element of a financial plan.

Conducting a Holistic Cost Efficiency Analysis

A true cost efficiency analysis for vehicle ownership must look beyond the simple purchase price or monthly payment. The most accurate model is the Total Cost of Ownership (TCO), which aggregates all expenses over a defined period: depreciation, financing costs (interest), insurance premiums, fuel, maintenance, repairs, and taxes/fees. Depreciation is the most variable and often the largest component in the early years. By modeling different purchase ages and holding periods, one can identify scenarios where a slightly higher purchase price for a younger, more reliable car is offset by significantly lower repair costs and stronger residual value, or where the low entry cost of an older car justifies a higher maintenance budget. This analysis reveals that the cheapest car to buy is rarely the cheapest car to own.

Developing a Proactive Market Timing Strategy

An effective timing strategy integrates knowledge of the depreciation curve with broader market intelligence. For sellers, the goal is to divest before a major value cliff, such as just before a costly scheduled maintenance event (e.g., a timing belt replacement at 100,000 miles) or before the vehicle exits a desirable demographic segment. For buyers, timing involves recognizing market opportunities. For example, purchasing a three-year-old vehicle just as a new model generation is released can yield exceptional value, as the outdated design of the previous generation accelerates its depreciation. Similarly, understanding seasonal demand cycles—where convertibles may command a premium in spring and 4x4 vehicles in early winter—can inform optimal buying and selling times to maximize value retention within your ownership window.

Q&A

Q: What exactly happens during the first depreciation phase when a car is driven off the lot?

A: A vehicle loses 20-30% of its value immediately upon becoming a "used" asset. This Initial Shock Depreciation occurs because a brand-new, identical model is still available, and the used buyer assumes unknown risks from the initial break-in period.

Q: When does a used car's value typically stop dropping so quickly?

A: The steepest decline in the value drop timeline usually ends around year four or five. The car then enters price stability years, where annual depreciation slows to 5-10%, as its value becomes tied to its remaining useful life rather than its age.

Q: From a purely financial standpoint, when is the best time to buy a used car?

A: Buying a car two to three years old is often the most strategic best ownership period. It has already suffered the largest depreciation hit (about 50% of total loss) but remains modern, reliable, and potentially under warranty, offering the best balance of cost and quality.

Q: Are there certain years in a car's life where its value becomes relatively stable?

A: Yes, most cars reach price stability years between ages five and ten. Depreciation slows significantly during this plateau, making the vehicle's annual cost of ownership primarily about maintenance and operation, not value loss.

Q: How can I use knowledge of depreciation in my buying and selling strategy?

A: A smart timing strategy involves buying a model right after a redesign, when the outgoing generation's price drops. Sell before major mileage milestones (e.g., 100,000 miles) that hurt resale value. For cost efficiency, buy at the start of the stability plateau and drive through it.